Easy to use easy to implement. Compliance Risk Concepts Sharing our Compliance Risk knowledge to help enable operational processes for long-term strategic and scalable success.

At Compliance Risk Concepts we provide clients with the critical skills and expertise required to establish maintain and enhance a balanced and effective compliance operational risk management program.

Compliance risk concepts. Contact us now for more details. Compliance Risk Concepts - YouTube Turning Risk Into Reward Compliance Risk Concepts CRC is a business-focused team of senior compliance consultants and executives providing top tier compli. Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification.

85 Rutledge Ave Charleston SC 29401. As the regulatory landscape is constantly evolving Compliance Risk Concepts CRC is issuing its monthly review and summary of FINRA SEC and NFA notices and bulletins to assist our clients in keeping abreast of notable regulatory developments and deadlines in an effort to strengthen their compliance and regulatory initiatives. Contact us now for more details.

As the regulatory landscape is constantly evolving Compliance Risk Concepts CRC is issuing its monthly review and summary of FINRA SEC and NFA notices and bulletins. Unlike traditional compliance consultants CRCs principal advisors have deep front office capital markets roots that consistently inform the solutions we prescribe to our clients. Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification.

Mitch Avnet founder of Compliance Risk Concepts explains the surging popularity behind bitcoin and whether or not the average investor should buy in now. Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers. At Compliance Risk Concepts CRC we provide clients with the critical skills and expertise required to establish maintain and enhance a balanced and effective compliance operational risk.

40 Exchange Place Suite 402 New York New York 10005. Ad C2020 compliance management provides a full compliance management logbook system. In 1966 the American Economist and Nobel Prize winner Bill Sharpe developed the Sharpe Ratio to help investors measure risk-adjusted returns.

Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers. Turning Risk Into Reward Compliance Risk Concepts We provide our clients with the critical skills and expertise required to establish maintain and enhance a balanced and effective compliance. At Compliance Risk Concepts we know that your business doesnt benefit from compliance advice thats academic or theoretical.

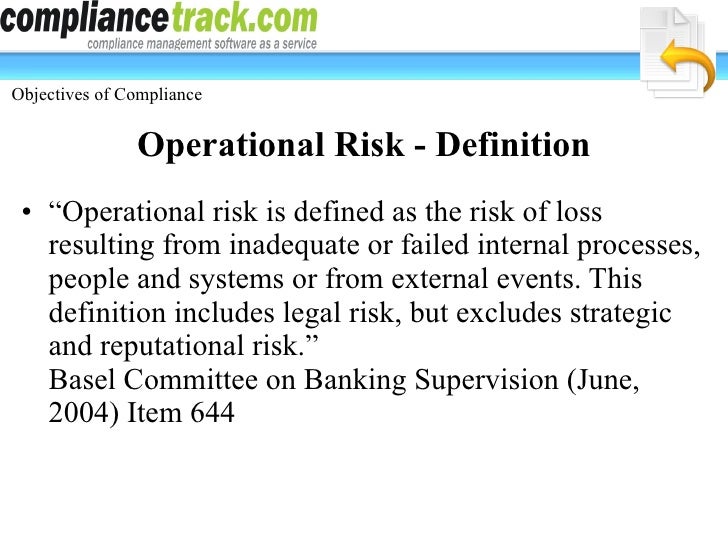

A key concept of compliance risk management is the risk assessment process which includes identifying and evaluating the potential risks that threaten an organizations ability to ensure it is compliant with laws and regulations. We provide our clients with the critical skills and expertise required to establish maintain and enhance a balanced and effective compliance operational risk. Over 5 decades later its still used as a key measurement in finance.

Yesterday at 707 AM. Compliance risk assessment. CRC is a business-focused team of senior compliance consultants and executives providing top tier compliance consulting services to clients on an as-needed project or part-time basis.

Bill is now helping Americans optimize their retirement savings through life. Compliance Risk Concepts March 26 at 635 AM Our team of senior compliance advisors and executives provides top tier compliance consulting services to. We help organizations demonstrate a commitment to a.

Risk assessment can include reviewing information sources such as reports from the. Ad C2020 compliance management provides a full compliance management logbook system. Easy to use easy to implement.

As a team made up of former CCOs and Senior Level Compliance Officers Compliance Risk Concepts brings the assurance of a balanced and effective compliance operational risk management programWe have all been in the seat understand our clients discrete set of compliance related risks and are true problem solvers.