Managing people is the most challenging part of any leaders day. In this role the PMO will work under the direction of the Principal Accounting Officer to ensure adequate coverage for SOX compliance.

Sarbanes Oxley Sox Compliance Abn Business Partners

What Is SOX compliance.

Sarbanes oxley compliance. The Sarbanes-Oxley Act introduced requirements around internal control over financial reporting and corporate governance. To help you achieve full compliance as painlessly as possible. Obtaining this understanding was an ongoing process throughout the project as the new regulation and accompanying guidelines were continually updated and refined.

Law meant to protect investors from fraudulent accounting activities by corporations. It came as a result of the corporate financial scandals involving Enron WorldCom and Global Crossing. The United States Congress passed the Sarbanes-Oxley Act SOX in 2002 to protect an enterprises shareholders and the general public from accounting errors and fraudulent practices and to improve the accuracy of corporate disclosures.

THE SARBANES-OXLEY COMPLIANCE KIT. The Sarbanes-Oxley Compliance Kit is designed specifically to educate explain and guide you through the process. Publicly-traded companies to provide evidence of adherence to strong internal control systems.

Sarbanes-Oxley Act and COBIT compliance. The Sarbanes-Oxley Act of 2002 often simply called SOX or Sarbox is US. The SOX PMO division of internal audit department has the primary responsibility of managing GitLabs Sarbanes-Oxley SOX compliance program.

Advertise with Sarbanes Oxley Compliance Journal Editors Bookshelf. Congress to protect shareholders and the general public from accounting errors and fraudulent practices in firms and to improve the accuracy of corporate disclosures. PwCs Sarbanes-Oxley SOX Compliance Solutions takes these factorsand their impact on compliance strategy structure people processes and technologyinto consideration through a strategic management lens.

Why SOX compliance is required. Effective in 2006 all publicly-traded companies are required to implement and report internal accounting controls to the SEC for compliance. Sarbanes-Oxley was enacted after several major accounting scandals in the early 2000s perpetrated by companies such as Enron Tyco and WorldCom.

Regulatory complexity is increasing business risks are evolving and the compliance challenges of today may not be the same tomorrow. The Sarbanes-Oxley Act of 2002 sponsored by Paul Sarbanes and Michael Oxley represents a huge change to federal securities law. These changes were undertaken in order to prevent similar scandals from occurring in the future.

The Sarbanes-Oxley SOX Act of 2002 that is based on the 107th congress of the United States of America oversees the audit of public companies that are subject to the securities laws and related matters in order to protect the interests of investors. Sarbanes-Oxley compliance requirements have elevated the role and responsibility of auditors while taking aim at the C-suites with tough new rules that call for increased accountability from top company executives. This attestation is appropriate for reporting on internal controls over financial reporting.

Microsoft cloud services customers subject to compliance with the Sarbanes-Oxley Act SOX can use the SOC 1 Type 2 attestation that Microsoft received from an independent auditing firm when addressing their own SOX compliance obligations. The Sarbanes-Oxley Act of 2002 often shortened to SOX is legislation passed by the US. SOX also known as Public Company Accounting Reform and Investor Protection Act in US Senate aims to protect stakeholders of securities markets shareholders of corporations buyers and sellers of.

So what is SOX. SOX Section 404 mandates the management assessment. Law to protect investors by preventing fraudulent accounting and financial practices at publicly traded.

Compliance requires an understanding of Sarbanes-Oxley provisions. It includes a whole series of resources intended to help simplify and set you on the right path. The Big Book of HR.

These include guides presentations and audit checklists. Section 404 requires firms to file an internal control report annually certifying that. Forum is an interactive chat type resource which enables the free exchange of information and opinion Also the AICPA is a relevant associations for CPAs.

The roles and responsibilities of the PMO include the following. To this end while SOX measures seek to govern the financial operations and disclosures of corporate entities and any of their contracted. Reacting to the corporate scandals which had seized public attention Congress enacted the Sarbanes-Oxley Act of 2002 and NYSE AMEX and NASDAQ adopted new rules addressing corporate governance.

The Sarbanes-Oxley Act sometimes referred to as the SOA Sarbox or SOX is a US. While the details of the Sarbanes-Oxley Act are complex SOX compliance refers to the annual audit in which a public company is obligated to provide proof of accurate data-secured financial reporting. The Sarbanes-Oxley Compliance Toolkit contains various downloadable resources to assist with the compliance exercise.

And that job certainly is not getting any easier. The Sarbanes-Oxley Act or SOX is one such key regulation governing the financial accounting practices policies of public enterprises that are based andor operating in the United States. Sarbanes-Oxley Compliance Journal a practitioners guide.

Cio Sarbanes Oxley Act Sox Soa Compliance Best Practices By Med Yones

Cio Sarbanes Oxley Act Sox Soa Compliance Best Practices By Med Yones

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Requirements Controls Dnsstuff

Sox Compliance Sarbanes Oxley Documentation

Sox Compliance Sarbanes Oxley Documentation

Sox Compliance Checklist Plus Best Compliance Tools Trials Demos

Sox Compliance Checklist Plus Best Compliance Tools Trials Demos

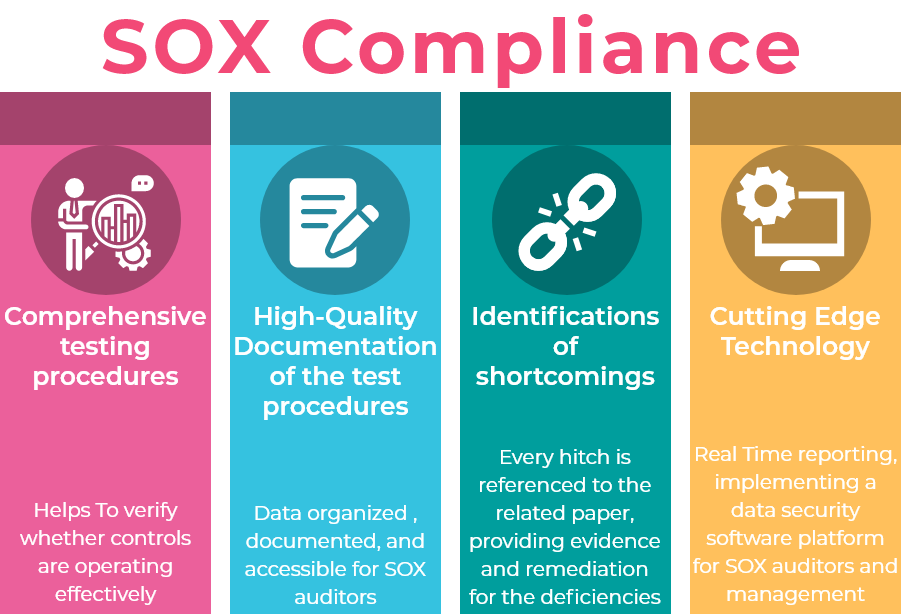

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

Sarbanes Oxley Act Sox Compliance Brief Digitech Systems Llc

Sarbanes Oxley Act Sox Compliance Brief Digitech Systems Llc

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Requirements Controls Dnsstuff

Sarbanes Oxley Compliance Cmdcpa

Sox Compliance Still Costs Companies Heavily Accounting Today

Sox Compliance Still Costs Companies Heavily Accounting Today

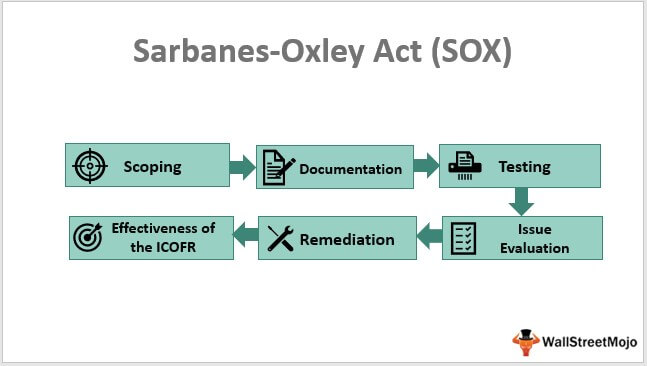

Sarbanes Oxley Act 2002 Sox Definition Steps For Compliance

Sarbanes Oxley Act 2002 Sox Definition Steps For Compliance

Sox Compliance For Your Organization Thales

Sox Compliance For Your Organization Thales

Sox Compliance Sox It Gap Assessment Alert Cyber

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

No comments:

Post a Comment