International companies are also subject to the act if they have registered equity or debt securities with the SEC. In addition certain provisions of Sarbanes-Oxley also apply to privately-held companies.

7 1 Fraud Internal Control And Cash 7

7 1 Fraud Internal Control And Cash 7

Is Your Organization SOX Compliant for 2021.

Sarbanes oxley applies to. Internal Auditings Role in Sections 302 and 404 of the US. International companies but not US. The law applies to all domestic public companies as well as non-public companies with publicly traded debt securities.

US and international companies. Law to protect investors by preventing fraudulent accounting and financial practices at publicly traded. 1 The Sarbanes-Oxley Act applies to which of the following companies.

Sarbanes-Oxley was enacted after several major accounting scandals in the early 2000s perpetrated by companies such as Enron Tyco and WorldCom. Sarbanes applies to all issuers including foreign private issuers. Parts of the act are applicable to all businesses irrespective of their size.

- registration of accounting firms that audit public companies in the US. Executives who approve shoddy or inaccurate documentation face fines of up to 5 million and jail time of up to 20 years. Mike Whitmire CEO and co-founder of FloQast sheds some.

The Sarbanes-Oxley Act sometimes referred to as the SOA Sarbox or SOX is a US. Sarbanes-Oxley Act of 2002. These questions include both short-term issues during the implementation phase of reporting processes as well.

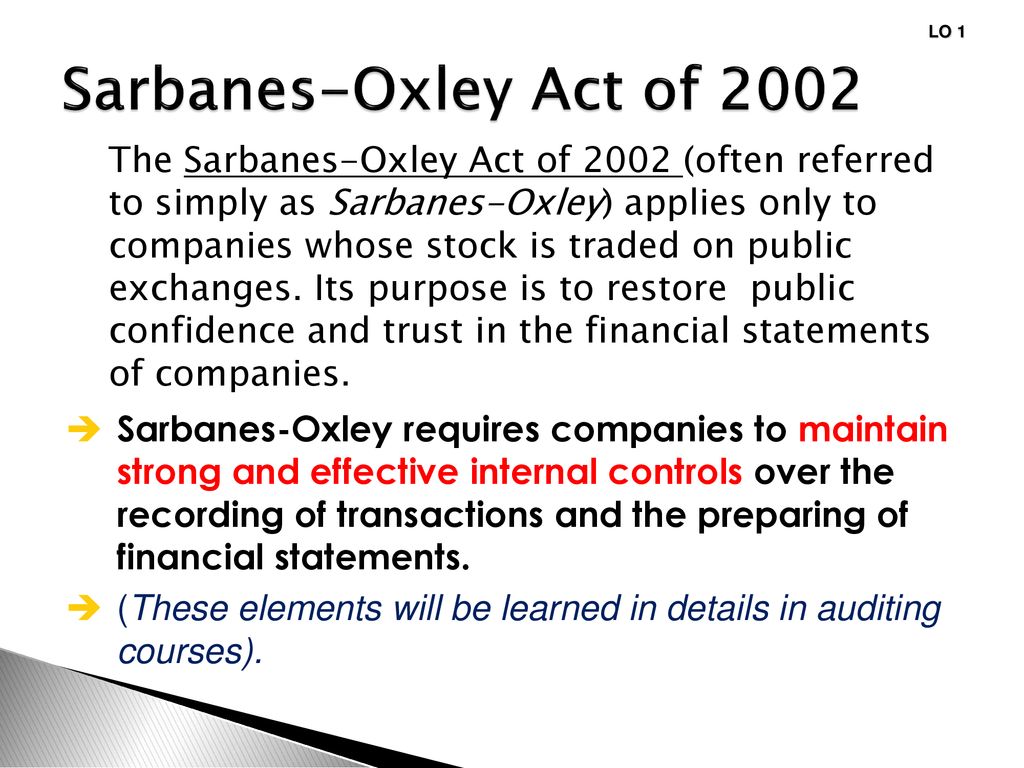

While the Sarbanes-Oxley Act principally applies to publicly traded companies its contents provide useful guidelines for good corporate practices that are equally applicable to many private companies and that may well affect private companies that maintain an ESOP. The Sarbanes-Oxley Act of 2002 often simply called SOX or Sarbox is US. What Is the Sarbanes-Oxley Act.

That is however not the case. What kinds of companies are covered under Sarbanes-Oxley. The application of Sarbanes to foreign private issuers.

Internal auditors have been confronted with a range of questions and issues related to their role and involvement in Sections 302 and 404 initiatives. AnswerC Evidence is paramount to audit and attestation engagements. The Sarbanes-Oxley Act has been part of the accounting world since 2002 when big corporate accounting scandals were making the headlines.

The Sarbanes-Oxley Act of 2002 is a law passed on July 30 of that year requiring corporations with publicly traded securities to adhere to certain standards in governance that increase the role board members play in overseeing financial transactions and. In addition Sarbanes provisions relating to auditor oversight and inde-pendence apply to all accounting firms including non-US accounting firms that audit foreign private issuers with securities registered in the US. Sarbanes-Oxley applies to all publicly held US.

Provisions of the Sarbanes-Oxley Act aka SoX Sarbox or SOA detail criminal and civil. - inspections of registered accounting firms. The 2002 Sarbanes-Oxley Act aims at publicly held corporations their internal financial controls and their financial reporting audit procedures as performed by external auditing firms.

A All companies B Privately held companies C Public companies D All public companies and privately held companies with assets greater than 500 million. The Sarbanes-Oxley Act is a federal law that enacted a comprehensive reform of business financial practices. The Sarbanes-Oxley Act applies to which of the following companies.

The Sarbanes Oxley Act gives to the PCAOB four primary responsibilities. Small business owners may think that the act is only applicable to public companies. Law meant to protect investors from fraudulent accounting activities by corporations.

SOX also applies to any accounting firm or third-party service company that provides financial or finance-related services to applicable companies. A All companies B Privately held companies C Public companies D All public companies and privately held companies with assets greater than 500 million Answer. The SarbanesOxley Act often referred to simply as SOX is a US federal law enacted in July 2002 with the aim of improving the accuracy and reliability of financial disclosures for all US public company boards management and public accounting firms.

Sarbanes Oxley applies to. List the four basic types of audit eviden. - establishment of auditing quality control and ethics.

C Which of the following is considered audit evidence. So what is SOX. Some sections of Sarbanes-Oxley apply to companies that do business with publicly traded companies even if they arent publicly traded themselves.