Risk is defined by COSO as the possibility that events will occur and affect the achievement of strategy and business objectives Risks considered in this definition include those relating to all business objectives including compliance. What is a regulatory risk.

Compliance Risks What You Don T Contain Can Hurt You Risk Compliance Journal Wsj

Compliance risk is also known as integrity risk.

Compliance risk definition. What is the definition of Compliance. Compliance risks are those risks relating to possible. Regulatory risks could for instance.

Compliance risk is the threat posed to an organizations financial organizational or reputational standing resulting from violations of laws regulations codes of conduct or organizational standards of practice. Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers. What is the Purpose of a Compliance Risk Assessment.

Compliance risk is the potential for losses and legal penalties due to failure to comply with laws or regulations. What are compliance and compliance-related risks. That rule may arise from an external source such as a law or regulation or an internal source such as a policy code or control.

Regulatory risk is the effect of a change in laws and regulations that could potentially cause losses to your business sector or market. Compliance risk is the potential that you will be deemed to have violated a law or regulation. Assessing Business Continuity Management BCM compliance risk is more than just making sure a program and its dimensions Program Administration Crisis Management Business Recovery Disaster Recovery and Supply Chain Risk Management meets the requirements of industry best practices standards and.

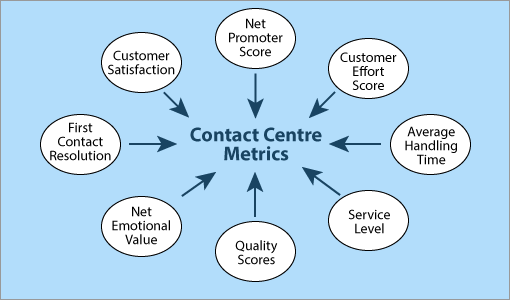

Compliance professionals must understand what a compliance risk assessment is and how to do it properly. Compliance is defined as the outcome for adhering to a rule. Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification.

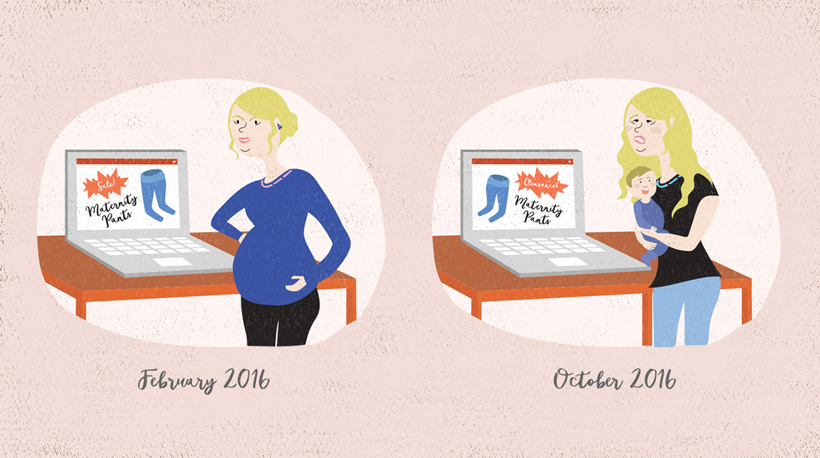

The expression compliance risk is defined in this paper as the risk of legal or regulatory sanctions material financial loss or loss to reputation a bank may suffer as a result of its failure to comply with laws regulations rules related self-regulatory organisation. In many cases businesses that fully intend to comply with the law still have compliance risks due to the possibility of management failures. What is compliance risk.

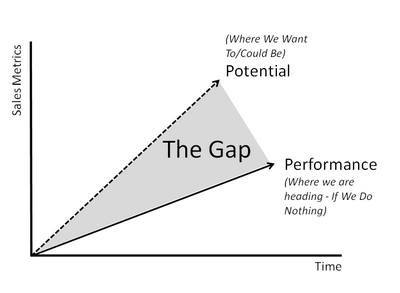

To understand their risk exposure many organizations may need to improve their risk assessment process to fully incorporate compliance risk exposure. Compliance risk captures the legal and financial penalties for failing to act under internal and external regulations and legislature. Compliance is an outcome of conforming to a rule.

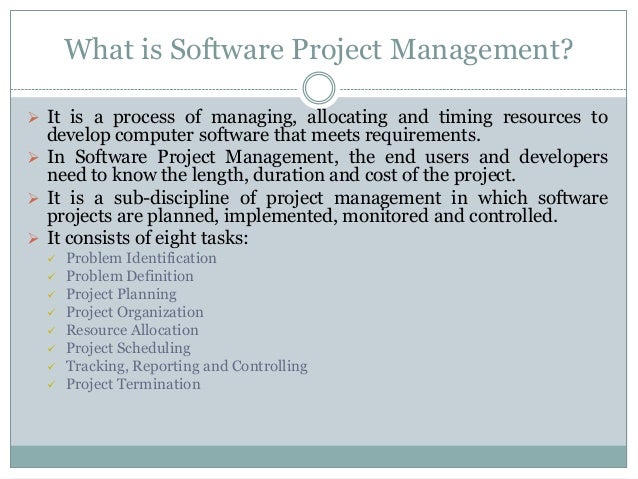

Specifically compliance risk is the threat posed to a companys financial organizational or reputational standing resulting from violations of laws regulations codes. What is Compliance Risk. Governance risk management and compliance GRC is a relatively new corporate management system that integrates these three crucial functions.

Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers. Compliance risk is an organizations potential exposure to legal penalties financial forfeiture and material loss resulting from its failure to act in accordance with industry laws and regulations internal policies or prescribed best practices. Regulatory risk is a potential that changes to laws regulations or interpretations will cause you lossesIn many cases compliance risk results from inadequate controls or issues related to.

The definition of legal risk overlaps in a certain degree with the one of compliance risk provided by EBA Guidelines on Internal Governance GL 44 the current or prospective risk to earnings and capital arising from violations or non-compliance with laws rules regulations agreements prescribed practices or ethical standards. To be able to comply the rules and regulations must be clearly defined and the following must be considered. Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification.

A flawed risk assessment process means that a company doesnt understand the actual risks it. Compliance and regulatory risks arise from laws and regulations that rely on penalties or sanctions to regulate the operations of a business. Compliance with these two main sources gives rise to external and internal compliance.

Compliance risk management which is a subset of compliance management involves identifying assessing and monitoring the risks to your enterprises compliance with regulations and industry standards putting internal controls in place to ensure that you are compliant and monitoring those controls to be sure that theyre effective on an ongoing basis.