The formula for calculating Cost of Goods Sold for retail businesses is. COGS On The Balance Sheet.

Understanding The Interim Cogs Account In Microsoft Dynamics Nav Archerpoint

Understanding The Interim Cogs Account In Microsoft Dynamics Nav Archerpoint

Impact of COGS on the Balance Sheet.

Cogs on balance sheet. Deferred COGS can only be reconciled as of today. Begging and ending inventory can be extracted from the balance sheet for the previous period and this period. The calculation of COGS in the current period is required to prepare a financial report especially profit and loss statement.

Cost of goods sold COGS refers to the direct costs of producing the goods sold by a company. CFI is the official provider of the Financial Modeling Valuation Analyst FMVA FMVA Certification Join 850000 students who work for companies like Amazon JP. A relatively simple way to determine the cost of goods sold is to compare inventory at the start and end of a given period using the formula.

The balance in the deferred COGS account code as set at Settings Accounting. When that inventory is sold it becomes an Expense and we call that expense as Cost of goods sold. We want to calculate Cost of Goods Sold for the business for the year 2019.

Thank you for reading this guide to accounting for the cost of goods sold. You can determine net income by subtracting expenses including COGS from revenues. Journal Entry for Cost of Goods Sold COGS The following Cost of Goods Sold journal entries provides an outline of the most common COGS.

Morgan and Ferrari. COGS Beginning Inventory Purchases Ending Inventory. Cost of Goods Sold COGS refers to the costs associated with acquiring or manufacturing goods to be sold by a company during a specific period of time.

Your COGS also play a role when it comes to your balance sheet. Nominal codes should be equal to the value of the items shipped on sales orders which have not yet been invoiced. Morgan and Ferrari FMVA Certification Join 850000 students who work for companies like Amazon JP.

These inventories were fully used up during the year recall that the company also recorded 20 in COGS during the year so inventories decreased by 20. This amount includes the cost of the materials and labor directly used to create the good. Inventory is listed as an asset that has disposable characteristics.

Your cost of goods sold can change throughout the accounting period. COGS Beginning Inventory Additional Inventory - Ending Inventory. A toy company had released its financial statements for 2019.

Under COGS record any sold inventory. It includes only those costs that are directly incurred in order to manufacture the goods including the cost of labor raw material and overhead expenditure related to the manufacturing of goods to be sold. Cost of Goods Sold Example.

It is not possible to reconcile as of a historical date. The businesss value is easier to understand and show to current or potential investors. You recorded 20 worth of paper cups and lemons under inventories.

Cost of goods sold figure is not shown on the statement of financial position or balance sheet but its constituent inventory indirectly affects profit or loss figure shown on the statement of financial position that is calculated in the statement of comprehensive income under the head cost of goods. The balance sheet for small business lists your businesss inventory under current assets. Furthermore the production value made during that year is calculated to be 1500000.

In the previous year of 2018 the company has an ending inventory of 550000. Inventory may be the largest current asset. COGS refers to the cost of goods that are either manufactured or purchased and then sold.

What is the Cost of Goods Sold COGS. Cost of Goods Sold COGS is one of the elements in Profit and Loss Report within trading company. Of the trading company is presented on the trial balance or on the companys balance sheet or previous years.

COGS is deducted from your gross receipts to figure the gross profit for your business each year. Its also an important part of the information the company must report on its tax return. COGS count as a business expense and affect how much profit a company makes on its products according to The Balance.

Inventory should be initially shown as an asset on the balance sheet because that is what it is. On the balance sheet we can see that the value of leftover inventory is 500000. List your ending inventory for the accounting period.

These costs are called cost of goods sold COGS and this calculation appears in the companys profit and loss statement PL. On a balance sheet the value of inventory is the cost required to replace it if the inventory were destroyed lost or damaged. Cost of goods sold is found on a businesss income statement one of.

You should record the cost of goods sold as a business expense on your income statement. Inventory is goods that are ready for sale and is shown as Assets in the Balance Sheet. On most income statements cost of goods sold appears beneath sales revenue and before gross profits.

Keeping the COGS reported in the same time frame as the associated sales of the product will also show the true picture of.

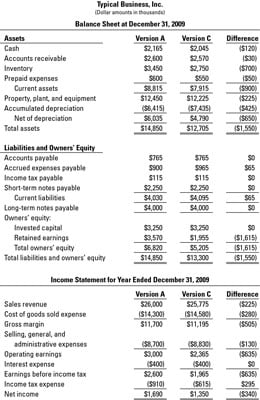

Solved Managing Growth Use The Provided Income Statement Chegg Com

Solved Managing Growth Use The Provided Income Statement Chegg Com

Cost Of Goods Sold In Balance Sheet Or Income Page 1 Line 17qq Com

Cost Of Goods Sold In Balance Sheet Or Income Page 1 Line 17qq Com

Inventory Cost Accounting And Cost Of Goods Sold Cogs Inventory Tracking Has Specific Effects On Your Bala Inventory Cost Cost Accounting Cost Of Goods Sold

Inventory Cost Accounting And Cost Of Goods Sold Cogs Inventory Tracking Has Specific Effects On Your Bala Inventory Cost Cost Accounting Cost Of Goods Sold

Solved The Following Balance Sheet And Income Statement P Chegg Com

Solved The Following Balance Sheet And Income Statement P Chegg Com

Chapter 6 Cost Of Goods Sold Expense And Inventory How To Read A Financial Report Wringing Vital Signs Out Of The Numbers 8th Edition Book

Chapter 6 Cost Of Goods Sold Expense And Inventory How To Read A Financial Report Wringing Vital Signs Out Of The Numbers 8th Edition Book

Solved The 2018 Income Statement Of Adrian Express Report Chegg Com

Solved The 2018 Income Statement Of Adrian Express Report Chegg Com

Calculating Cost Of Goods Sold And Inventory Cost Dummies

Calculating Cost Of Goods Sold And Inventory Cost Dummies

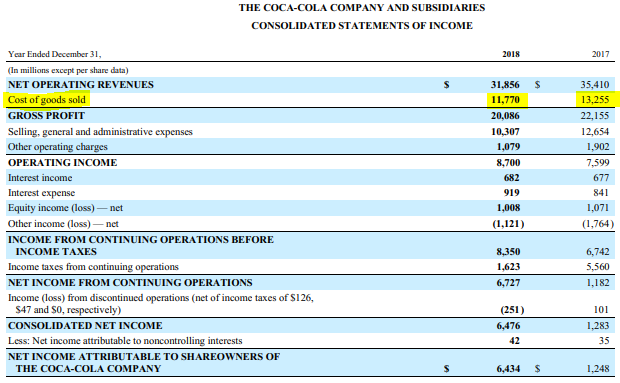

How Cost Of Goods Sold Cogs Can Help Find Great Company Moats

How Cost Of Goods Sold Cogs Can Help Find Great Company Moats

Cost Of Goods Sold On An Income Statement Definition Formula Video Lesson Transcript Study Com

Cost Of Goods Sold On An Income Statement Definition Formula Video Lesson Transcript Study Com

Cost Of Goods Sold Cogs Pengertian Dan Cara Mencari Dalam Laporan Keuangan Cocoshoppers

Cost Of Goods Sold Cogs Pengertian Dan Cara Mencari Dalam Laporan Keuangan Cocoshoppers

Cogs On The Balance Sheet The Inventory Software Blog By Simms

How Bankers Look At Your Financial Statements People Relationships Results Ppt Download

How Bankers Look At Your Financial Statements People Relationships Results Ppt Download

Breaking Out Material Labor And Overhead For The Balance Sheet Archerpoint

Breaking Out Material Labor And Overhead For The Balance Sheet Archerpoint

Explain And Demonstrate The Impact Of Inventory Valuation Errors On The Income Statement And Balance Sheet

Explain And Demonstrate The Impact Of Inventory Valuation Errors On The Income Statement And Balance Sheet

No comments:

Post a Comment